Become a CERTIFIED FINANCIAL PLANNER

and Broaden your Career Paths

Gain the skills and knowledge you need to

become a successful CERTIFIED FINANCIAL PLANNER

About Certified Financial Planner

Certified Financial Planner (CFP) is a leading Certification globally recognized in the field of Financial Planning with over 213000 CFP professionals. It is popular in more than 27 territories across the world. It is a globally recognized certification for financial professionals. CFPs are trained and authorized to provide comprehensive financial planning advice to individuals, covering areas such as investments, retirement planning, tax strategies, and estate planning. It is a professional mark for financial planners granted by the Financial Planning Standards Board (FPSB).

About Certified Financial Planner

Certified Financial Planner (CFP) is a leading Certification globally recognized in the field of Financial Planning with over 213000 CFP professionals. It is popular in more than 27 territories across the world. It is a globally recognized certification for financial professionals. CFPs are trained and authorized to provide comprehensive financial planning advice to individuals, covering areas such as investments, retirement planning, tax strategies, and estate planning. It is a professional mark for financial planners granted by the Financial Planning Standards Board (FPSB).

CFP Course Details and Eligibility

|

Duration |

|

||

|

Eligibility |

|

CFP Course Details and Eligibility

|

Duration |

|

||

|

Eligibility |

|

Why Choose VGLD?

|

Authorized Education Providers |

|

100% Placement Assistance |

|

Flexibility of Online Sessions |

|

Learn from Industry Experts |

|

50% discount on FPSB India Study Material |

|

Question bank for self-practice |

|

1 on 1 mentorship study plan |

|

EMI financing |

Enquire Now

120+ hours of Online Training

Recorded Sessions Available 24/7 in HD

Why Choose VGLD?

|

Authorized Education Providers |

|

100% Placement Assistance |

|

Flexibility of Online Sessions |

|

Learn from Industry Experts |

|

50% discount on FPSB India Study Material |

|

Question bank for self-practice |

|

1 on 1 mentorship study plan |

|

EMI financing |

Enquire Now

150+ hours of Online Training

Recorded Sessions Available 24/7 in HD

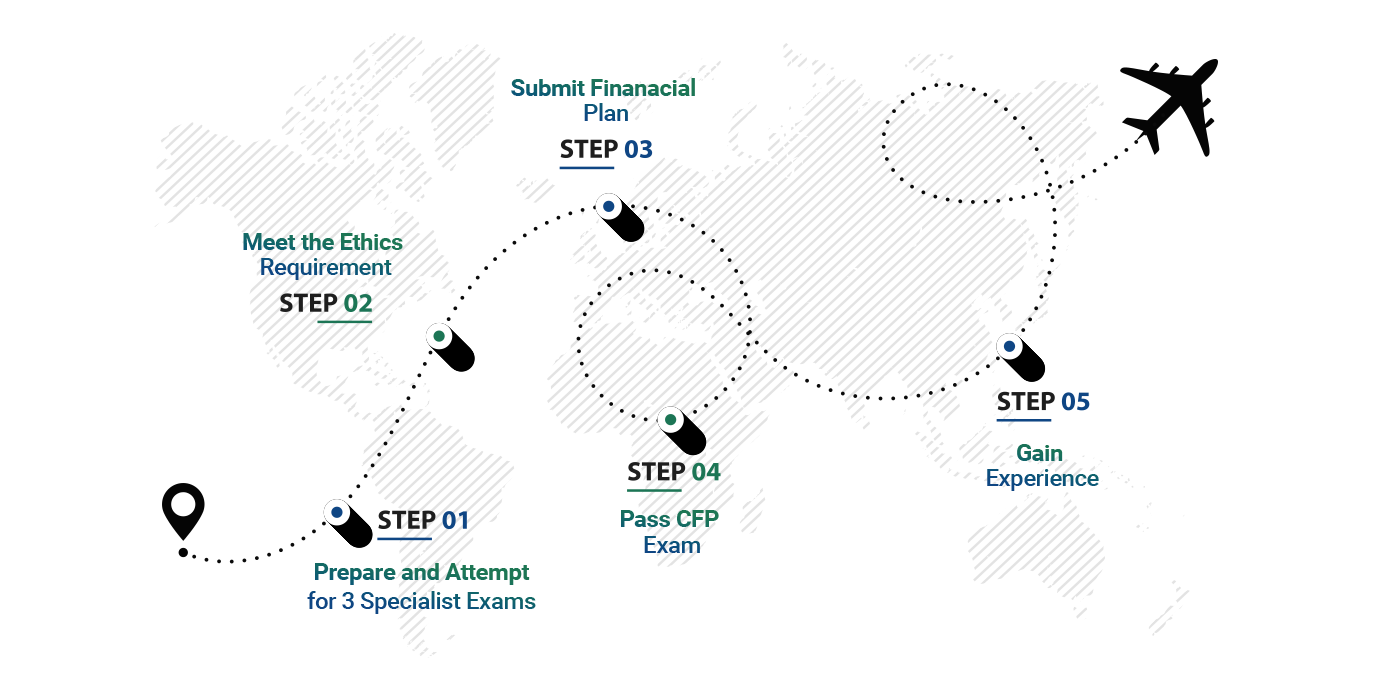

CFP Certification Process

CFP Course Content |

||

Investment Planning

Investment Planning

|

Integrated Financial Planning

Integrated Financial Planning

|

|

Retirement & Tax Planning

Retirement & Tax Planning

|

Financial Plan Assessment

Financial Plan Assessment

|

|

Risk and Estate Planning

Risk and Estate Planning

|

CFP Exam

CFP Exam

|

|

CFP Course Content |

||

Investment Planning

Investment Planning

|

Integrated Financial Planning

Integrated Financial Planning

|

|

Retirement & Tax Planning

Retirement & Tax Planning

|

Financial Plan Assessment

Financial Plan Assessment

|

|

Risk and Estate Planning

Risk and Estate Planning

|

CFP Exam

CFP Exam

|

|

Career Opportunities

FAQ's

If you're seeking excellent education for Certified Financial Planner (CFP) certificant, choose VGLD. They are the experts, ready to address all your questions. Call us at +91-9700000038 or visit www.vglearningdestination.com

The minimum eligibility criteria for the Regular Pathway is a 12th-grade passing certificate from a recognized board.

Rated as "One of the Best Jobs" by U.S. News and World Report, 2012

Rated as Gold Standard by Wall Street Journal

The most recognized and respected financial planning certification in 27 territories

Supported, recognized, promoted, and preferred by 48 organizations of the BFSI Industry

The starting salary of a certificant Financial Planner ranges from 5 lacs – 15 lacs depending upon the field of work.

Yes, the CFP designation is recognized globally. It signifies a standardized level of competency in financial planning and is respected in many countries, providing opportunities for international career mobility.

The CFP exam covers various topics, including financial planning principles, investment planning, retirement planning, tax planning, estate planning, and more. It assesses the candidate's ability to apply knowledge in real-world financial planning scenarios.

Yes, When a CFP professional wants to practice financial planning using the CFP marks in multiple territories, they must get certified for each territory they intend to practice in If certified in more than one territory, they need to adhere to the renewal requirements of each territory's FPSB affiliate organization and be overseen by them.

6 – 12 Months

The CFP exam is exclusively conducted online. After completing and passing a course, students have the opportunity to register for the certification exam, which is also administered online.

The CFP mark and CFA charter are prestigious designations in their fields, governed by respective bodies. CFP professionals focus on Personal Finance, while CFA charterholders focus on corporate finance.