Become an ENROLLED AGENT

US TAX EXPERT

and Broaden your Career Paths

Gain the skills and knowledge you need to

become a successful ENROLLED AGENT

About Enrolled Agent

Enrolled Agent (EA) is a federally authorized tax practitioner who has technical expertise in the field of taxation and who is empowered by the US Department of the Treasury to represent taxpayers before the IRS (Internal Revenue Service). As an enrolled agent you will be able to prepare tax returns, represent clients before IRS, have unlimited representation rights, appeal for clients in front of IRS and advice clients on tax implications based on their business transactions.

About Enrolled Agent

Enrolled Agent (EA) is a federally authorized tax practitioner who has technical expertise in the field of taxation and who is empowered by the US Department of the Treasury to represent taxpayers before the IRS (Internal Revenue Service). As an enrolled agent you will be able to prepare tax returns, represent clients before IRS, have unlimited representation rights, appeal for clients in front of IRS and advice clients on tax implications based on their business transactions.

Enrolled Agent Course Details and Eligibility

|

Duration |

|

||

|

Minimum |

|

Enrolled Agent Course Details and Eligibility

|

Duration |

|

||

|

Minimum |

|

Why Choose VGLD?

|

Weekend Classes (Saturday & Sunday) |

|

10 hours on the weekend |

|

120+ hours of Live online classroom training |

|

GLEIM Review course with 96% pass rate |

|

6500 Multiple Choice Questions |

|

Partnered with Fortune 500 companies |

|

Experienced and passionate faculty |

Enquire Now

120+ hours of Online Training

Recorded Sessions Available 24/7 in HD

Why Choose VGLD?

|

Weekend Classes (Saturday & Sunday) |

|

10 hours on the weekend |

|

120+ hours of Live online classroom training |

|

GLEIM Review course with 96% pass rate |

|

6500 Multiple Choice Questions |

|

Partnered with Fortune 500 companies |

|

Experienced and passionate faculty |

Enquire Now

150+ hours of Online Training

Recorded Sessions Available 24/7 in HD

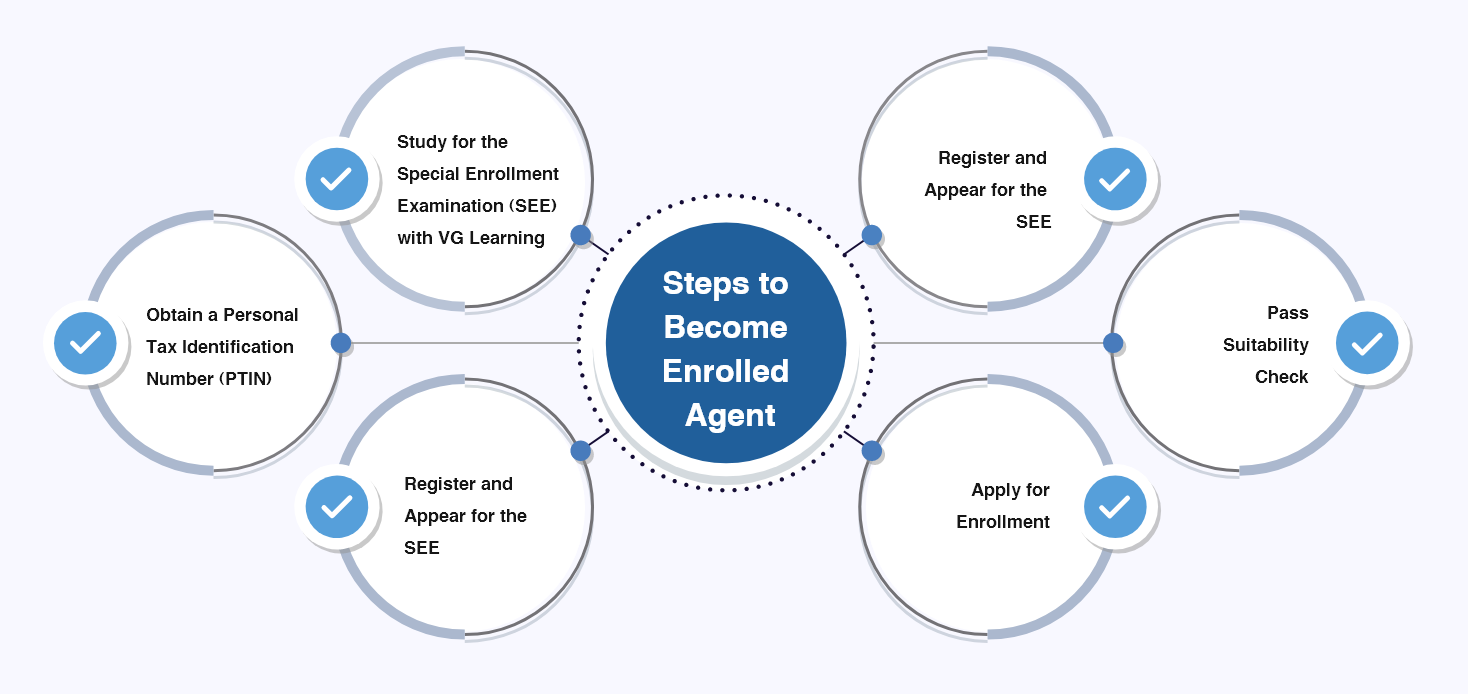

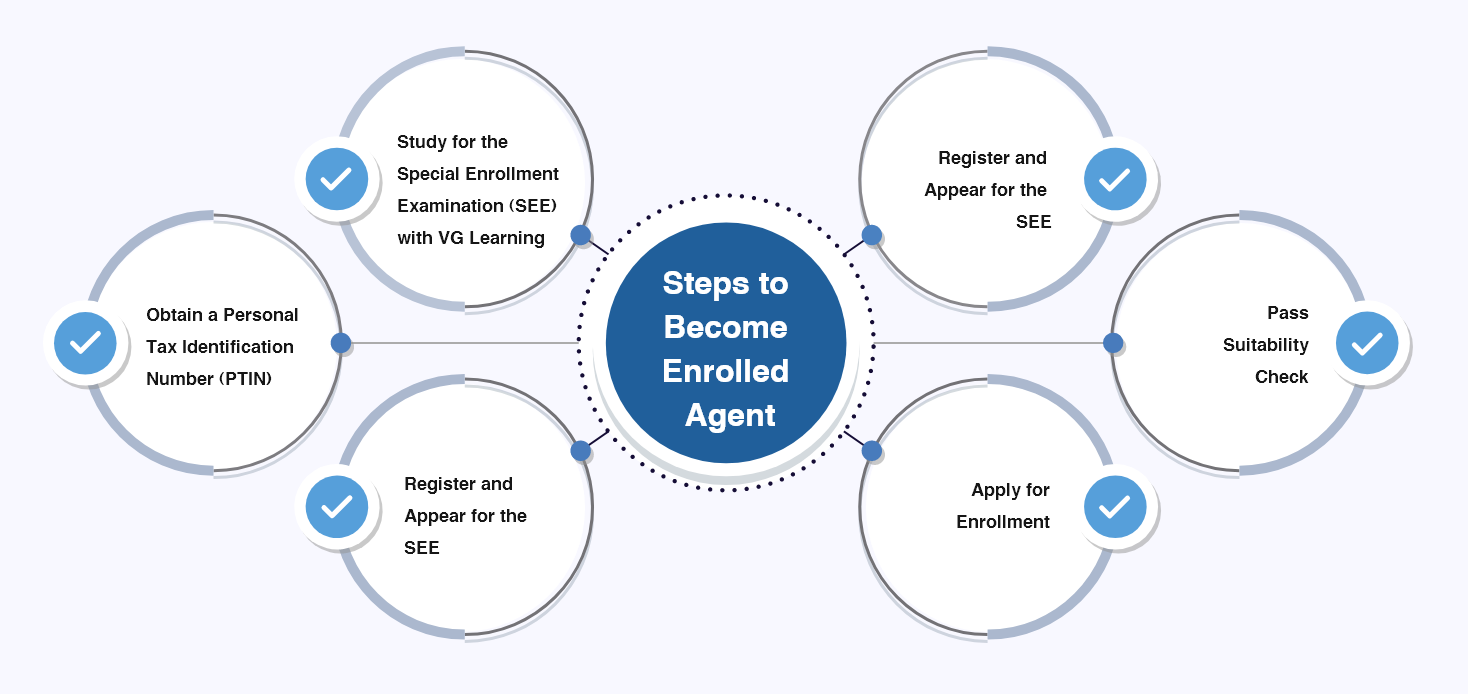

Enrolled Agent Certification Process

Enrolled Agent Certification Process

Enrolled Agent Course Content |

||

|

Part 1: Individuals |

Part 2: Businesses |

Part 3: Representation, Practices and Procedures |

Income and Assets

Income and Assets

|

Business Entities and Considerations

Business Entities and Considerations

|

Practices and Procedures

Practices and Procedures

|

Deductions and Credits

Deductions and Credits

|

Business Tax Preparation

Business Tax Preparation

|

Representation before the IRS

Representation before the IRS

|

Taxation

Taxation

|

Specialized Returns and Taxpayers

Specialized Returns and Taxpayers

|

Specific Areas of Representation

Specific Areas of Representation

|

Advising the individual taxpayer

Advising the individual taxpayer

|

Filing Process

Filing Process

|

|

Specialized Returns for Individuals

Specialized Returns for Individuals

|

||

Enrolled Agent Course Content |

||||||||

|

Part 1: Individuals |

Part 2: Businesses |

Part 3: Representation, Practices and Procedures |

||||||

|

|

|

||||||

|

|

|

||||||

|

|

|

||||||

|

|

|||||||

|

||||||||

Career Opportunities

-

Work as Tax Practitioner with Big 4 accounting firms

Work as Tax Practitioner with Big 4 accounting firms

-

Expand practice to United States of America

Expand practice to United States of America

-

Work with taxation departments of BPO’s & KPO’s

Work with taxation departments of BPO’s & KPO’s

-

Work with US-based multinationals in India e.g. Amazon

Work with US-based multinationals in India e.g. Amazon

-

Work with Indian companies with presence in US

Work with Indian companies with presence in US

-

Work with Shared Service Centers and F&A Companies

Work with Shared Service Centers and F&A Companies

Enquire Now

Career Opportunities

-

Work as Tax Practitioner with Big 4 accounting firms

-

Expand practice to United States of America

-

Work with taxation departments of BPO’s & KPO’s

-

Work with US-based multinationals in India e.g. Amazon

-

Work with Indian companies with presence in US

-

Work with Shared Service Centers and F&A Companies

Top global companies

which hire

Enrolled Agent

Top global companies

which hire

Enrolled Agent

Instructors

Mr. Abhinav Raparia

(CPA (US), CA, MBA)

Instructors

Mr. Abhinav Raparia

(CPA (US), CA, MBA)

FAQs

EAs are generally tax preparers, but they can also wear an advisory hat by providing tax compliance counselling to clients or providing written advice to third parties regarding business transactions. In general, the EA's job is to help their clients with a variety of tax matters, from tax preparation, to representation during hearings or conferences, to helping them through audits. EAs can be seen in an office, in front of the IRS, or sitting down with clients. They work in accounting firms of all types and sizes, with many EAs starting their own businesses.

Unlike the most other professional designations, you can become an Enrolled Agent (EA) without earning a college degree. Plus, once you become an EA, your credential is valid in all 50 states. Whether you have decades of experience in tax or recently decided to make a career change from something completely unrelated, you are eligible to take the Enrolled Agent Examination (referred to as the Special Enrolment Examination, or SEE, by the Internal Revenue Service). A background in taxation helps make the process easier, but there have been students with zero tax experience who studied and passed the Enrolled Agent Exam – on their FIRST attempt! Here’s are the requirements to become an EA:

- You must be at least 18 years old

- You must have an active Personal Tax Identification Number (PTIN) from the IRS

- You must pass all three parts of the Enrolled Agent Exam

- You must be in compliance with U.S. Tax laws

- How many sections are in CPA?

- Each paper is for a period of four hours with 50% MCQ-based questions and 35-50% simulation and written-type questions.

The Enrolled Agent Exam is taken at Prometric Centers which are available worldwide